In the context of technology, silent upgrades are one of the more intriguing examples of an 'everyday anonymous'.

The term refers to the process where software is updated automatically without explicit user interaction or notification – think how platforms like iOS and Android exemplify this, often downloading and installing crucial updates to your phone overnight.

These upgrades are designed to be unobtrusive, often running during periods of minimal activity, and the subtle orchestration in the background ensures that our devices are constantly at their optimum performance levels but also reflects a broader shift towards a more fluid, user-centric approach in technology management.

For lenders, the advantages of silent upgrades in hosted technology platforms extend beyond mere convenience. They embody a strategic approach to software management, aligning with the needs of dynamic financial environments where responsiveness, security, and efficiency are not just valued but are imperative.

The Essence and Advantages of Silent Upgrades

At their core, silent upgrades focus on enhancing and updating the backend software platform automatically without disrupting operations or a user's experience. It would include everything from essential bug fixes and crucial security patches to new, innovative features.

Enhanced security is a standout benefit, as the timely deployment of security patches and compliance updates drastically minimizes vulnerability and ensures timely regulatory adherence. This methodology also allows for rapid adoption of new features across the user base, leading to quicker, more efficient feedback and innovation cycles. Similarly, the immediate adoption of the latest functionalities and improvements can provide a competitive edge by leveraging new tools and capabilities as soon as they are available. In addition, updates often include performance enhancements, leading to improved stability and efficiency of the software platforms.

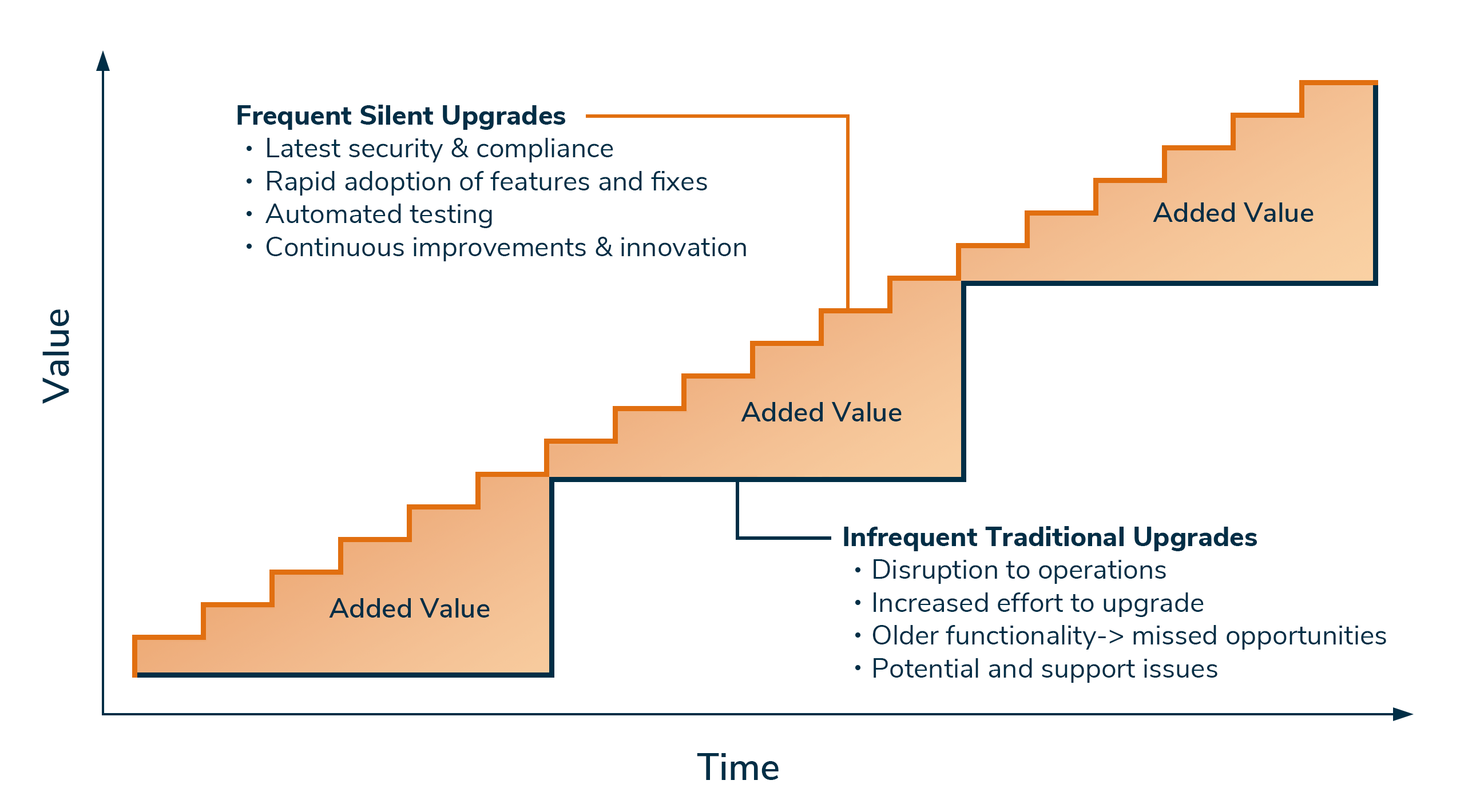

Ultimately, frequent silent upgrades deliver business value sooner than traditional upgrades – as illustrated in Fig. 1 below.

Coupled with the above, this approach yields several other significant benefits.

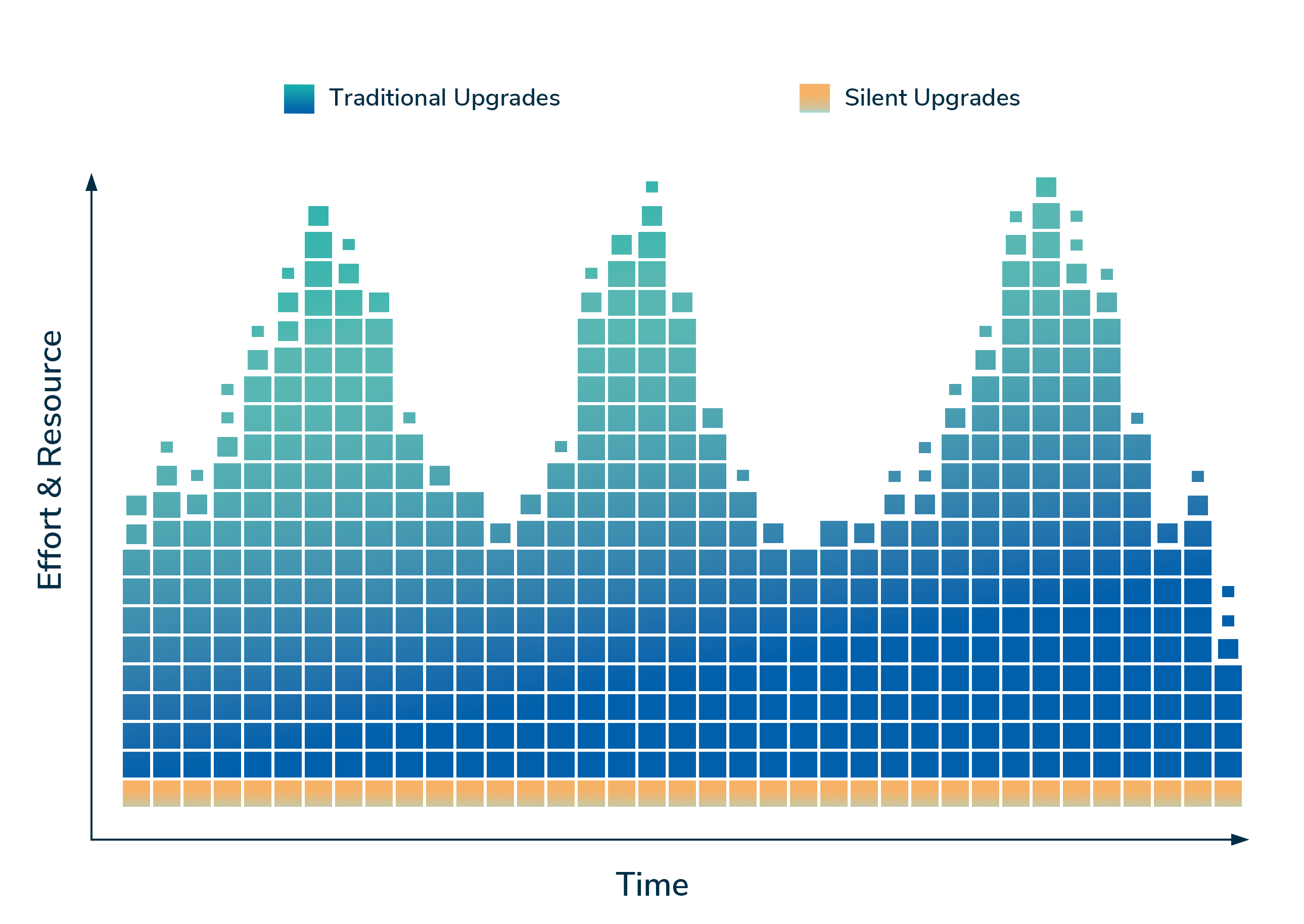

Where traditional upgrades can have long timelines and require comprehensive resource allocations, silent upgrades can eliminate these challenges - reducing the effort required for regression testing and alleviating the need for extensive IT involvement throughout the deployment process. Paired with the instant accessibility to the latest functionalities, the reduction in maintenance burdens further streamlines operations, making these platforms more efficient and user-friendly.

To further illustrate the efficiency of silent upgrades compared to traditional upgrade methods, we have included a visual comparison (Fig. 2) showing differences in effort and resource allocation over time.

We're a small business and don't have a large IT function but we recognise technology's role in meeting customer needs and operational demands. One of the key benefits of moving to the Lendscape solution to support our operations is that when it comes to our technology, we keep our effort and energy to a minimum. Additionally, we get the benefits of product development we may not have commissioned, but which could improve our service offering.

- Mark Nelson, Compass Business Finance

From a user's perspective, they would experience minimal interruption to their workflows, and the business would have minimal disruption to operations. Users may require continuous training, but incremental changes are typically easier to adapt to than major releases or changes to software.

While potentially increasing short-term maintenance costs, frequent upgrades often lead to long-term savings for businesses which are quite significant. By consistently updating, lenders can avoid expenses and resource costs associated with more extensive system upgrades, which tend to be far costlier than routine maintenance. Furthermore, avoiding frequent upgrades to save money in the short term can result in missed opportunities - and might lead to higher costs in the future due to outdated systems and inefficiencies.

Implementing Silent Upgrades: A Delicate Balance

Implementing silent upgrades, however, requires a nuanced approach. Despite a host of benefits, silent upgrades are not without their challenges. For instance, updates involving data migrations or significant schema changes require meticulous planning and execution to limit downtime.

In addition, a robust and secure system for the delivery and installation of upgrades is fundamental. This system must support implementing and integrating continuous delivery while capable of handling the complexities of financial software and absolute data integrity.

Thanks to Lendscape, Compass has consistently and effectively upgraded silently to the latest version of the platform without causing any disruptions to our service. As a part of this process, they have communicated to us clearly about the changes and benefits of new features and performed rigorous testing to ensure everything runs smoothly. These upgrades require no time commitment from our team, allowing us to focus on our core activities while benefiting from Lendscape's evolving technology.

- Mark Nelson, Compass Business Finance

At Lendscape, we believe that silent upgrades must fit seamlessly into a personalised environment – ensuring no conflicts with customised integrations or bespoke workflow requirements. Extensive testing across environments and scenarios is critical, however, an effective strategy for rolling back updates is also essential to rectify any issues that might arise post-deployment quickly and without hassle. This safety net is crucial for maintaining trust with our clients and ensuring their operational continuity.

Moreover, we understand some lenders may prefer greater control over their update processes. Whether optional opt-out mechanisms or scheduling options for upgrades, controls can be in place to address user concerns and ensure smooth transitions. While the silent upgrades are unobtrusive by nature, transparency and communication are key, and offering insights into what changes are made and why can help lenders maximise efficiency and prepare for and leverage new features more effectively.

In conclusion, silent upgrades are a pivotal advancement in technology management, especially for financial services, offering benefits like enhanced security, compliance, and operational efficiency while giving lenders a competitive edge through streamlined operations and rapid new feature adoption. The key lies in balancing automation with oversight and ensuring clear communication to maximise benefits.

As technology evolves, silent upgrades' role in software management becomes increasingly vital, with their adoption essential for financial institutions to leverage the most advanced tools available, a necessity when staying ahead of the curve is synonymous with success.

***

Author: Steve Taplin

Editor: Iain Gomersall

For Finance Providers:

- Capital Optimization: Collaborative financing enables efficient use of capital, allowing finance providers to engage in larger transactions without overextending their balance sheet.

- Risk Mitigation: Syndication allows lenders to diversify their portfolios, spreading risk across multiple deals and industries and reducing exposure to potential losses.

- Network Expansion: Participating in syndicated deals fosters connections with other finance providers, opening doors to new opportunities.

For Borrowers:

- Access to Larger Funds: Syndicated finance accommodates substantial funding needs that may be beyond the capacity of a single lender, offering borrowers access to a broader pool of capital.

- Flexible Terms: With multiple lenders involved, borrowers may be able to negotiate more favorable terms, including interest rates and covenants.

- Speed and Efficiency: Syndicated deals often streamline the lending process, leveraging the expertise and resources of multiple lenders to expedite due diligence and approval.